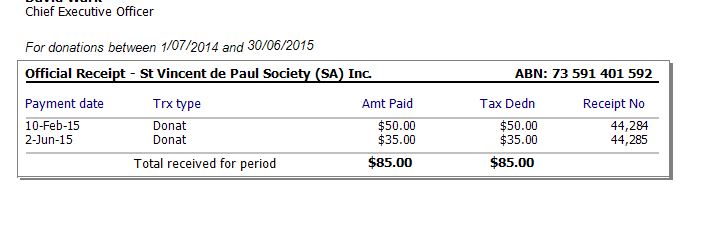

Your contact may request that you produce an a receipt at the End of the Financial Year detailing all the transactions they have made to your organisation.

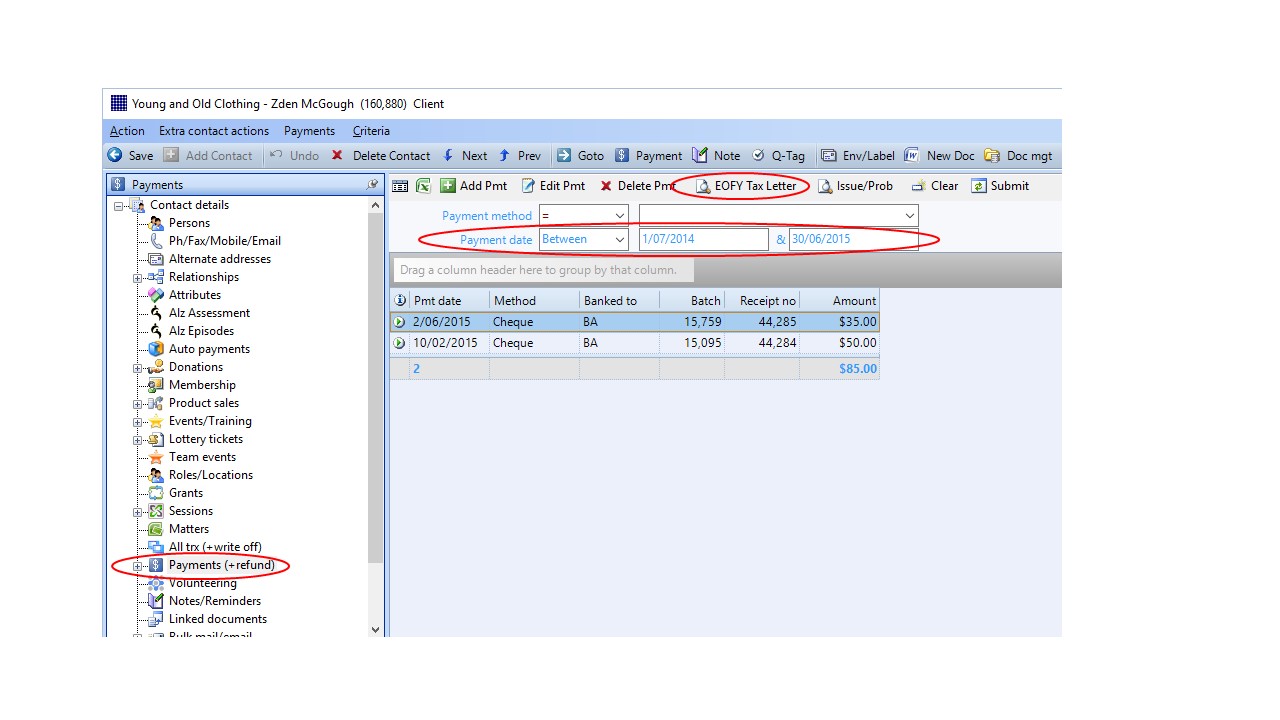

To do this, select the contact as usual. Then go to Payments (+ refunds) and select the date range of interest (i.e. start and end of the financial year) and click submit. Now click on EoFY Tax Letter menu option which will invoke Crystal Reports and the letter.

The letter will have a receipt stub with the payments detailed in the screen above.

Please contact Gestalt Software if the Receipt Letter is not configured as required for your organisation. Not all clients use the EoFY Tax Letter so it may not have been configure for your organisation.